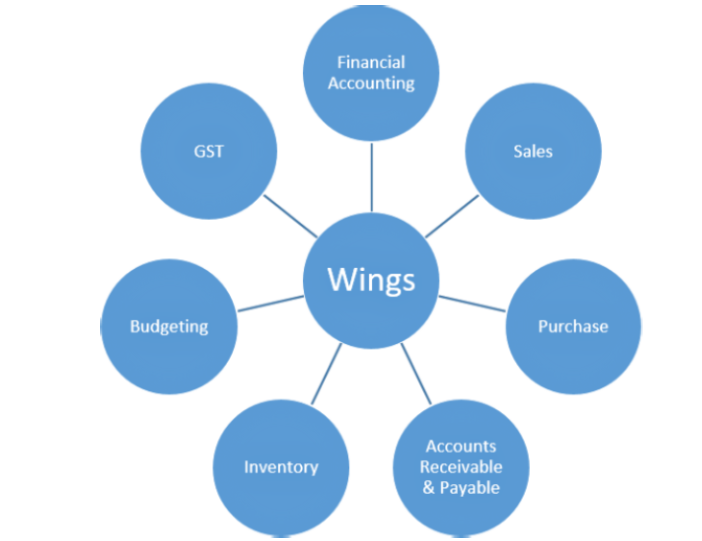

- Financial Accounting

- Sales

- Purchases

- Inventory

- Accounts Receivable & Payable

- Budgeting

- GST Returns

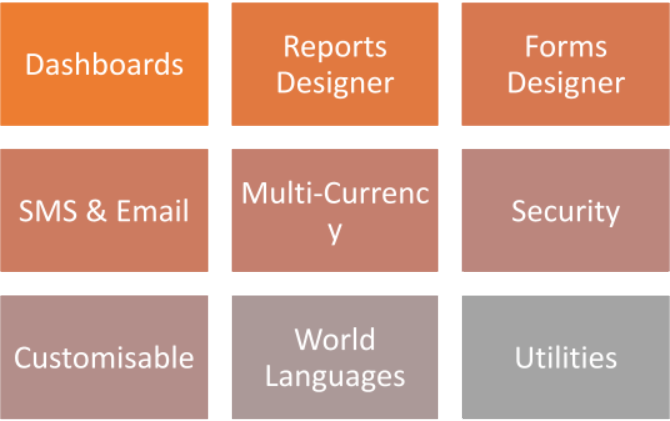

The complete functionality is packed with great features and utilities to make accounting easy for you. This includes:

- Dashboards

- Reports Designer

- Forms Designer

- SMS & Emailing

- Auto Software Updates

- Print Template Gallery

- Branches, Divisions, Projects, Cost Centres

Wide Scope

- Financial Accounting

- Sales

- Purchases

- Receivables & Payables

- Inventory Management

- Budgeting

- Segments

- GST

- TDS

- Tools & Utilities

Wings features complete financial accounting. It captures all finance transactions and generates all the books and records you need. In addition, it takes care of Post-Dated Cheques and Bank Reconciliation.

Books & Reports

Wings generates all reports, analyses and books you will need from your accounts:

- Profit & Loss

- Balance Sheet

- Trial Balance

- General Ledger

- Cash, Petty Cash & Bank Books

- Day Books & Journal

- GSTR reports for filing GST returns. – GSTR-1, GSTR-2, GSTR-3B, GSTR-4, GSTR-9.

It also offers extensive analysis including:

- Trend Analysis

- Transaction Analysis

- Balances

- Peak Balances

- Consolidated FA Report

Bank Reconciliation

Wings makes bank reconciliation easy.

Post Dated Cheques

Wings manages your Post Dated Cheques completely. It takes care of both PDCs issued and received. It includes:

- All PDCs

- PDCs Received

- PDCs Issued

- Ledger (PDC Account)

Wings automates the entire Sales function - from ordering to sales and collections.

You can keep track of sales, free goods issued, discounts given, adjustments made, taxes, payments received and other costs incurred during sales.

You may raise a sales invoice against an order, a delivery note or by itself.

Sales module covers:

- Proforma Sales/Quotations

- Sales Orders

- Deliveries

- Sales Invoices

For easy GST compliance, sales (and returns) can be captured as below

- Sales Invoice (Tax Invoice)

- Sales Invoice (Retail)

- Sales Invoice (Exports)

- Sales Invoice (Exempted)

Sales transactions automatically post to accounts and inventory.

Reports & Analysis

You can understand sales performance, determine profitable product lines, analyse sales trends, seasonal trends for products, customer preferences and patterns, sale history etc.

- Sales & Advanced Sales Book

- Sales Order Book

- Sales Analysis Reports

- Top N Customers Vs Products

- Top N Customers Vs 5 Products

- Sales Analysis – By Party & Period

- Sales Analysis – By Party & Product

- Sales Analysis – By Product & Period

- Sales Analysis – By Product & Party

Purchases

Wings helps you manage your purchases as easily as Sales. Record your purchases, free goods received, discount received, adjustments and taxes involved, and payments made during purchases.

The Purchase module covers

- Proforma Purchases

- Purchase Orders

- Material Receipts

- Purchase Invoices

For easy GST compliance, purchases (and returns) can be captured as below:

- Purchase Invoices (Tax Invoice)

- Purchase Invoice (Exempted)

- Purchase Invoice (Imports)

Transactions automatically post to accounts and inventory.

Reports & Analysis

You can understand purchases performance, determine profitable product lines, analyse purchases trends, seasonal trends for products, customer preferences and patterns, sale history etc.

- Purchases & Advanced Purchases Book

- Purchases Order Book

- Purchases Analysis Reports

- Top N Customers Vs Products

- Top N Customers Vs 5 Products

- Purchases Analysis – By Party & Period

- Purchases Analysis – By Party & Product

- Purchases Analysis – By Product & Period

- Purchases Analysis – By Product & Party

Manage receivables and payables completely with Wings. Track of dates for bills, get ageing analysis, over dues, interest calculations, reminders letters and more.

Specify minimum and maximum credit and debit limits, maximum credit period, and maintaining records of previous year balances.

During credit sales or purchases you may specify due dates of payments. Reports can be taken for specified due dates to view the overdue bills and calculate interest, optionally.

In Receipts or Payments you may set off the correct Invoice against which the transaction is affected.

Reports

The AR/AP reports include:

- Receivables List

- Payables List

- Pending Bills

- Bill Details

- Overdue Receivable

- Overdue Payables

Wings features the most complete inventory management in its class.

Scope

The module covers:

- Product classification based on various properties or attributes

- Batches with manufacturing and expiry dates (optional)

- Upto 4 units of measure along with conversion factors

- Multiple prices and lists for sales and purchases

- Free Issues, Packages

- Discount rates and applicable tax slabs to each product

- Delivery Notes, Material Receipt Notes

- Internal Consumption, Transfers

- Opening Stock, Shortages and Excesses

- Stock Valuation on multiple bases

- Multiple market values for each product for valuation.

- Reorder Management

- Deep analysis of inventory.

- And, more.

Reports & Analysis

Wings gives the most incisive analysis and reports about inventory. This includes:

- Stock Ledger

- Stock Valuation (FIFO, Weighted Average, Weighted Average Daily, Weighted Average Monthly)

- Stock List

- Expired Stocks

- Reorder Report

- Transaction Analysis

- Trend Analysis

- Stock Balances

- Exception Reports

- DC & MR Report

- Invoice-wise Profit

- Product-wise profitability

- Top Products

- Orders booked by party

- Orders booked by product

- Orders booked by date

Budgeting

Define separate budgets for each account or a group of accounts for any period.

The creation of budgets is easy and very flexible.

- Create of any number of Budgets - each for a separate use.

- Get Budget Variance analysis and Budget Allocation Reports.

Segments

Wings helps you manage any number of Branches, Locations, Projects and Divisions.

Classify your transactions by attaching them to a branch, project, location or a division. You can allocate a segment to the entire transaction or for each line. For example, you may allocate expenses to a branch, issue of stocks to a location etc.

Wings will give you reports by one or more segments. A powerful analysis tool.

GST

Wings is GST ready and helps you comply with GST completely and easily.

You may create and manage multiple HSNs, SACs, Products and Services, Customers and Suppliers with GST details such as their GSTINs, addresses etc.

Tax Invoices can be created with ease and taxes are automatically computed based on the product or services supplied, place of supply – Inter-state, Intra-state, Export/Import etc.

Wings supports computation of taxes inclusive or exclusive of prices. The user has the choice to select the method of computation.

All business processes, including sales, purchases, inventory, incomes and expenses, take care of GST related functionality.

Wings generates all GST related reports including data for statutory reports.

Wings interfaces with Wings GST Filer to enable online interface with GSTN portal for seamless filing of returns. Wings also offers data to be used by the GST Offline Tool.

TDS

Wings does automatic calculations of Tax Deduction at Source (TDS) based on the nature of payment. It keeps track of applicable rates, TDS collected and deposited, documents issued/received, effective dates and the period within which the collected TDS is to be deposited.

You may specify TDS Slabs, TDS Documents Issuable / Receivable, TDS Deposits and take the related reports.

Wings puts enormous power in your hands to have total control over your system and get the most out of it.

Dashboards

Wings offers Dashboards for every function, giving a snapshot of that function from various angles. These show key metrics and allow you to go deeper into the data and view reports. Invaluable.

Reports Designer

The powerful Wings Report Designer Books offer tremendous power of analysis to you. With these, you may view your data in any manner you wish – and also design new reports for your analysis.

You may set appearance, layout contents, format, filters, sort orders, language and apply formulae and conditions to the reports. You can even see the reports in two languages. You may save the new or modified reports in the menus for future use.

You will get to know your business like never before, and take better decisions.

Forms Designer

Design any number of print templates for invoices, vouchers, cheques and all other documents with the Forms Designer.

You may customize the appearance of the printed documents by using text, images, logos, and more, for plain and pre-printed paper, and laser and dot matrix printers.

Email Documents, Reports

Wings helps you email all documents – reports, formatted documents, invoices etc – to any party directly.

SMS

Send text messages to customers and suppliers from transactions and reports. The messages can be customised and can include data from the system.

Multi-Currency

Wings enables comprehensive multi-currency by transacting, accounting, reporting in all currencies. Define foreign currencies, symbols, prefixes and suffixes, and exchange rates in terms of company currency. Specify exchange rates on a daily basis.

Wings does complete multi-currency accounting for every transaction, helps manage exchange gains and losses.

Security

Wings offers tight security. Create any number of users and give or deny each specific rights to create, access, view, print, cancel, print, delete masters, transactions and reports. With Wings, you are secure.

World Languages

Wings can work in major world and Indian languages. Wings will work in the language specified and for Arabic it will flip screens to appear from right to left. Maintain a personal dictionary to help with better translation.

Customisable

Wings is hugely customisable. The entire menu and all screens would adjust according to the preferences set.

- Modules can be enabled or disabled.

- Transaction Screens can be customised for appearance, content, behaviour, formats etc.

- Extra fields may be added to any transaction and reports.

- Drop downs may be customised to include data from the system.

- Field captions can be changed at will.

- Data can be imported or exported to CSV/Excel files.

Tools

Wings offers several valuable tools.

- Renumber Vouchers

- Easy Year End Process

- Automatic Backups

- Drill Down in reports

- Dual Mode Printing – on dot matrix and laser printers

- Keyboard Friendly

- Short-Cut Menus

GST, TDS, TCS

Wings helps you manage and comply with GST regulations completely, in an online or offline manner, with all the required tools. It takes care of e-invoicing, e-way bills, GST returns filing, invoice matching etc.

Likewise, Wings helps you manage and comply with TDS and TCS requirements including invoicing, reports, returns etc.

Auto Software Updates

Wings updates itself over the internet with the latest releases and feature additions.